When it comes to saving for retirement, choosing the right account can make a world of difference. Roth IRA and Traditional IRA are two of the most popular options, each offering distinct advantages depending on your financial goals. These accounts not only offer tax benefits but also provide flexibility in how you manage and grow your savings. But how do you decide which one is best for you? Let’s break down the differences and explore which one aligns with your future plans.

Traditional IRA: The Tax Break Now, Pay Later Option

With a Traditional IRA, the magic happens upfront. Your contributions are tax-deductible, which means you lower your taxable income for the year you contribute. However, the catch is that when you withdraw funds during retirement, you’ll pay taxes on them. This can be a good option if you’re in a high tax bracket now and expect to be in a lower one in retirement.

One thing to keep in mind is the “Required Minimum Distribution” (RMD)—once you hit 73, you’ll be required to start taking withdrawals, whether you need the funds or not.

Top Providers for Traditional IRAs:

- Fidelity Investments: Known for a user-friendly platform and wide range of investment options, Fidelity makes it easy to manage your IRA and plan for retirement.

- Vanguard: If you prefer low-cost investment options, Vanguard is famous for its commitment to low fees and long-term investment strategies.

- Charles Schwab: For those who appreciate simplicity and support, Schwab offers a streamlined platform with lots of tools to help you stay on track.

Roth IRA: Tax-Free Growth for Your Future

With a Roth IRA, the taxes come later—at least when it comes to withdrawals. While you don’t get a tax break on contributions, your withdrawals in retirement are completely tax-free, as long as you meet certain conditions. This makes Roth IRA a great choice if you think you’ll be in a higher tax bracket in retirement or if you simply want to avoid paying taxes on your earnings when you retire.

What’s more, Roth IRAs don’t have the same required minimum distribution (RMD) rules as Traditional IRAs, meaning you don’t have to start taking withdrawals at age 73. This added flexibility is appealing to many savers.

Top Providers for Roth IRAs:

- Charles Schwab: Offering diverse investment options and great planning tools, Schwab is perfect for those looking to maximize the tax-free growth of their Roth IRA.

- TD Ameritrade: With a robust platform that allows you to invest in a wide range of assets like stocks, bonds, and ETFs, TD Ameritrade gives you the tools to grow your Roth IRA with ease.

- E*TRADE: Ideal for those looking for advanced trading tools and a vast array of investment options, E*TRADE allows you to take full control of your Roth IRA.

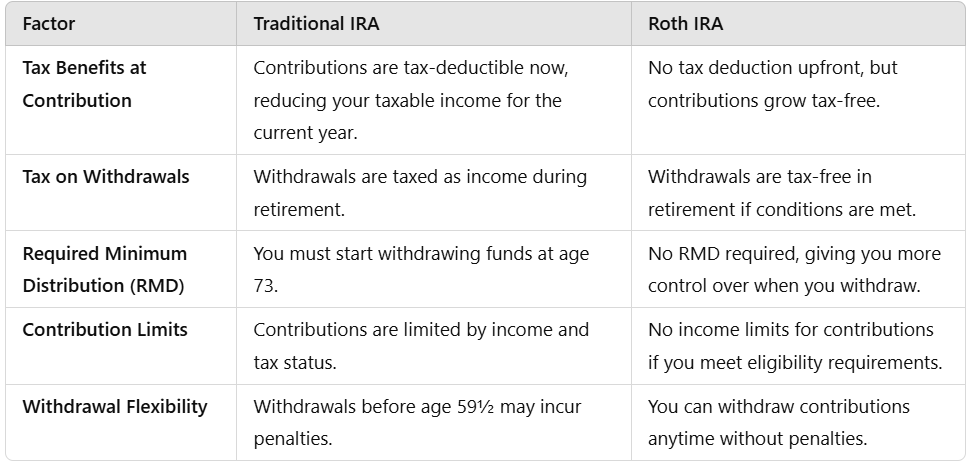

Roth IRA vs. Traditional IRA: A Quick Comparison

Which One is Right for You?

Ultimately, the decision between a Roth IRA and a Traditional IRA depends on your current tax situation and retirement goals. If you’re seeking immediate tax relief and expect to be in a lower tax bracket during retirement, a Traditional IRA might be the way to go. On the other hand, if you want the ability to grow your savings tax-free and avoid paying taxes on your earnings in retirement, a Roth IRA could offer you a better long-term strategy.

By choosing the right account and provider, you can set yourself up for a more secure and tax-efficient retirement. Consider speaking with a financial advisor to better understand which option is best for you and how to take full advantage of the retirement savings opportunities available.